Discover, MasterCard, Visa, & Amex are accepted

Flexible Financing

Why wait to have the peace of mind of a standby generator? With our new financing program now you can not only have the highest quality generator installation possible, but also the best financing options. It is quick, safe, and simple to apply for financing, and you will receive a response within minutes.

You can finance your generator installation in part or in full, with no early prepayment penalty in most cases. With flexible 0% interest long-term financing terms available, we can help make your standby power project affordable so you can protect your home and family now, then pay over time.

Have a question? Call us at 716-314-1743.

Now Available: Payments as low as $150 per month!

Features:

- Payments as low as $150/mo. with no money down

- Fixed, flexible term options. No early prepayment penalties

- No equity or collateral is needed. No appraisal or third-party inspections.

- Quick and simple application process through a trusted local lender

- 0% interest terms available!

- Call (716) 314-1743 for more info

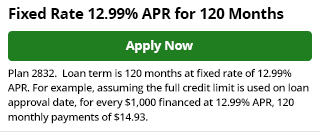

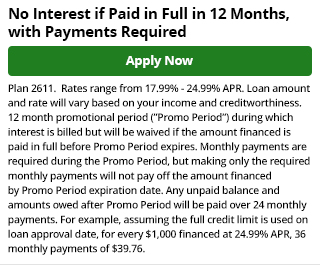

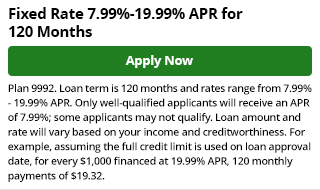

Financing Options From GreenSky

Synchrony Bank

- A simple application process, and fast credit decisions

- Unsecured, revolving credit lines

- Promotional financing options1

- Convenient monthly payment options

- Online account management

KeyBank

Get an unsecured Home Improvement Loan.** A fixed-rate, no-collateral loan for home updates, repairs, and generator installations.

A KeyBank Home Improvement Loan can provide you with the funds you need to see your standby generator project through. Use this quick and simple loan to get your generator installed now, without using your home’s equity or credit cards.

Overview:

| Interest Rate: | Low, fixed interest rate |

| Loan Amount: | Starting at $5,000 |

| Term: | Up to 84 months |

| Flexible Payment Options: | Yes |

| Collateral Needed: | No |

| Manage in Online Banking: | Yes |

Features:

- No equity or collateral needed

- No appraisal or third-party inspections

- Quick and simple application process

- Fixed, flexible payment options

Contact KeyBank Representative Martin Carns at 585-739-5521 for more information or to get started applying for your loan. After approval, he will come to you on your time to take care of all the paperwork and get you squared away.

You can access your loan statements, check your loan’s remaining balance, and make payments using online banking.

In order to apply, you must:

- Be at least 18 years of age or older

- Live in one of the following states: AK, CO, CT, ID, IN, MA, ME, MI, NY, OH, OR, PA, UT, VT, or WA

- Agree to provide any additional personal and business information, if requested such as tax returns and financial statements

- Certify that all of the information provided in the application is true and correct.

- Authorize the bank and/or a credit bureau to investigate and verify the information provided within the application.

*Subject to credit approval. Minimum payments required.

**All credit products are subject to credit approval